Newly released findings from the 2021 Barometer Study reveal the majority of Black Americans own life insurance (56%), up three percentage points from 2020 and four percentage points higher than the general population. Yet this still represents a 19-point gap from the 75% of Black Americans who believe they need life insurance.

“While our research shows that Black Americans are more likely to own life insurance than any other race, the reality is 46% — 20 million adults — say they need (or need more) life insurance coverage, which identifies a significant coverage gap,” said David Levenson, president, and CEO, LL Global, LIMRA, and LOMA. "It is up to our industry to help these individuals get the coverage they need to protect their families’ financial security.”

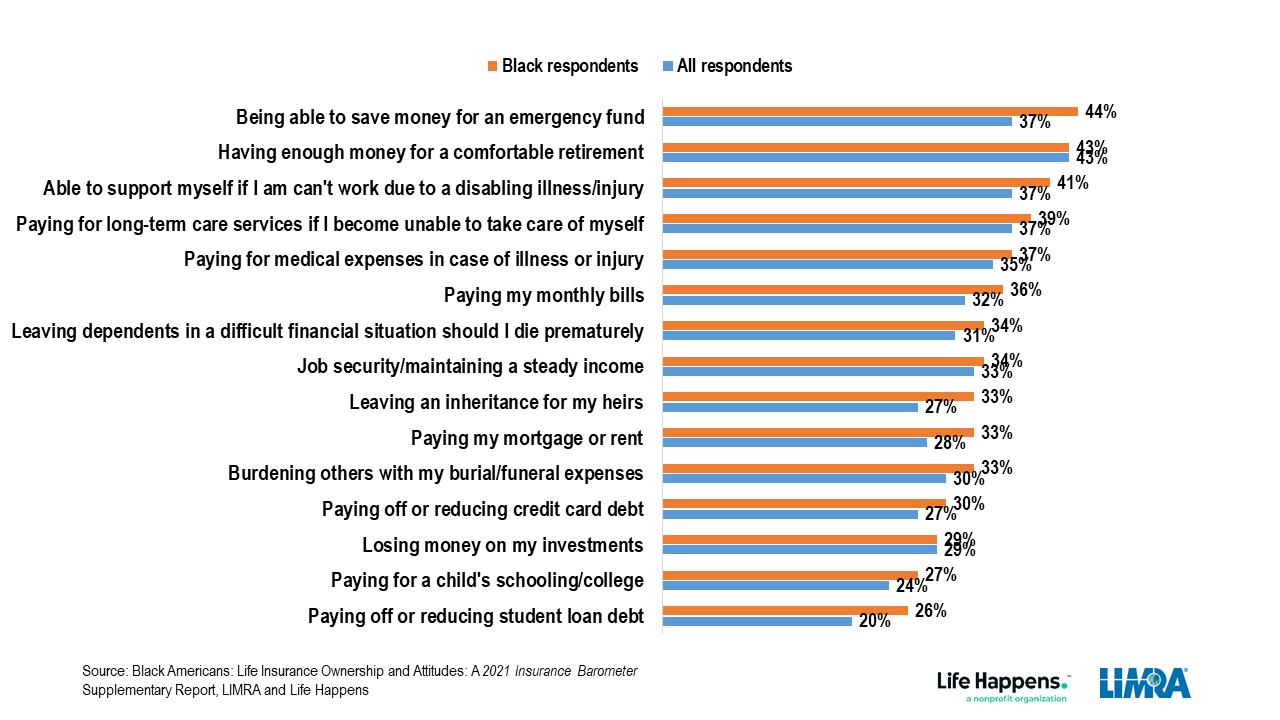

Black Americans experience higher levels of financial concerns

The study finds Black Americans report a higher level of financial concern than the overall population average and COVID-19 exacerbated these concerns. Black Americans were significantly more likely to be concerned about being able to save for an emergency fund, pay their monthly bills and their mortgage, and leaving their families in a difficult situation due to a premature death.

“The prevalence of these concerns, coupled with the disproportionate impact of COVID-19 on Black Americans, are driving forces behind their likelihood to buy life insurance in the next year,” noted Levenson. “Our research shows 6 in 10 Black Americans plan to purchase life insurance within the next year, which is much higher than the national average (36%).”

Misconceptions may deter Black Americans from getting (enough) coverage

Like most Americans, Black Americans’ misconceptions about life insurance prevent them from getting the coverage they need. While the top reason Black Americans give for not purchasing coverage is that it’s too expensive, the study finds Black Americans are more likely than the general population to overestimate the cost of life insurance (75% versus 50%). They are more likely to believe the coverage they get through their employer is adequate, as well.

The study also shows that Black Americans are more likely than other market segments to view life insurance only for burial and final expenses. Thirty percent of Black Americans believe that life insurance is only for final expenses and 66% say that is the primary reason they own life insurance. Just 48% of the general population say the same. This perception of life insurance could result in Black Americans not purchasing enough coverage to provide income replacement or enable wealth transfer, two key ways life insurance can benefit loved ones after a wage earner dies.

Looking for advice

Prior LIMRA research shows that those who work with a financial professional are more likely to purchase life insurance. According to the study, 43% of Black Americans currently work with a professional financial advisor and another 30% indicate they are currently seeking a financial advisor, which is higher than the general population average.

“The findings from this report demonstrate that we still have work to do to educate consumers about how affordable and accessible life insurance really is or the many ways it can be used as a foundation to protect the ones we love,” said Levenson. “Working with the 330,000 life-licensed agents and advisors, the industry can help dispel consumers’ misconceptions about life insurance and remove some of the obstacles that prevent Americans from getting the coverage they need.”

LIMRA leads the Help Protect Our Families campaign, an industry-wide effort to raise awareness about the importance of life insurance and help carriers and distributors address the growing coverage gap in the United States. NAIFA is proud to support this campaign.

The 2021 Insurance Barometer Study, conducted jointly by industry nonprofit LIMRA and Life Happens for the past 11 years, examines the financial attitudes and behaviors of Americans, with an emphasis on life insurance.

View the Black American Life Insurance Ownership Infographic.

Study methodology

In January 2021, LIMRA and Life Happens engaged an online panel to survey adult consumers who are financial decision-makers in their households. The survey generated over 3,000 responses, including more than 300 Black Americans.

ABOUT LIMRA: Serving the industry since 1916, LIMRA is a worldwide research, consulting, and professional development not-for-profit trade association. Nearly 700 financial services companies in 53 countries rely on LIMRA’s research and educational solutions as the trusted source of industry knowledge to help them make bottom-line decisions with greater confidence.

ABOUT NAIFA: The National Association of Insurance and Financial Advisors is the preeminent membership association for the multigenerational community of financial professionals in the United States. NAIFA members subscribe to a strong Code of Ethics and represent a full spectrum of financial services practice specialties. They work with families and businesses to help Americans improve financial literacy and achieve financial security. NAIFA provides producers a national community for advocacy, education and networking along with awards, publications and leadership opportunities to allow NAIFA members to differentiate themselves in the marketplace. NAIFA has 53 state and territorial chapters and 35 large metropolitan local chapters. NAIFA members in every congressional district advocate on behalf of producers and consumers at the state, interstate and federal levels.